The World Customs Organization (WCO) released the latest version of the Harmonized Tariff Schedule (HTS) on 1st January 2022. The seventh edition of the commodity codes incorporates significant changes for importers, exporters, eCommerce-related businesses and marketplaces. The Harmonized System is worldwide accepted and used as the common goods classification mechanism in international trade and the 2022 updates predominantly impact the eight and ten-digit tariff schedules, such as the UK Global Tariff and the EU’s Taric.

–

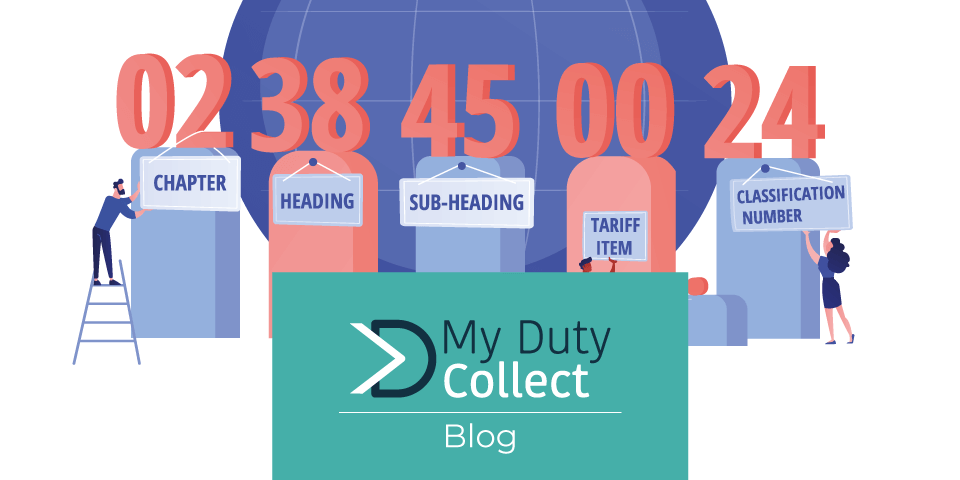

READ MORE: Get to Know Our HS Classification Engine

–

The WCO has made approximately 350 amendments, including over 70 headings and subheadings changes covering a wide range of goods that will cross borders around the world. Apart from the new HTS classifications, exporters and importers must also be aware of eventual new duty rates, product descriptions and customs procedures. Not all countries have integrated the new HS2022 version yet, but specialists believe that the transition period will take at least six months, based on previous experiences. The European Commission has launched the updated version of the Combined Nomenclature, which is applicable across all EU member states.

What Products Groups Are Most Affected?

Chapter 85 (Electrical Machinery, Parts, etc) – 33 amendments

Chapter 44 (Wood and Articled of Wood) – 25 amendments

Chapter 84 (Mechanical Appliances, Parts, etc) – 21 amendments

Section XI (Textiles and Apparel) – 19 amendments

Chapter 3 (Fish and Crustaceans, Molluscs) – 18 amendments

Chapter 29 (Organic Chemicals) – 14 amendments

How to Get Prepared for the Changes?

In order to answer this question, we should have in mind that some countries will take longer to internalize the new HTS changes, however, it’s never too early to start. The United States and The United Kingdom have already updated their database, which can now be integrated to third-party systems or internal classification engines. At this point, auditions are recommended to ensure the accuracy of codes as well as begin mapping existing codes to the 2022 updates.

Key Considerations:

– Before any review of the HS2022 updates, traders must make sure their commodity codes are correct;

– Validation of all HS changes against the correlation table. When exporting, for example, traders will need to validate the HS codes against the correlation table of the country of import;

– Outdated commodity codes can cause bottlenecks and customs declarations can be refused;

– Be aware of eventual changes in grants qualification based on preferential origin rules;

– Validate eventual new duty rates changes.

If you are interested in learning more about the new HTS updates to enhance your company’s regulation compliance in international trade, subscribe to our blog and visit our website and LinkedIn page for more updates. You can also reach out to us by sending a message to info@mydutycollect.com. We will be delighted to hear from you.